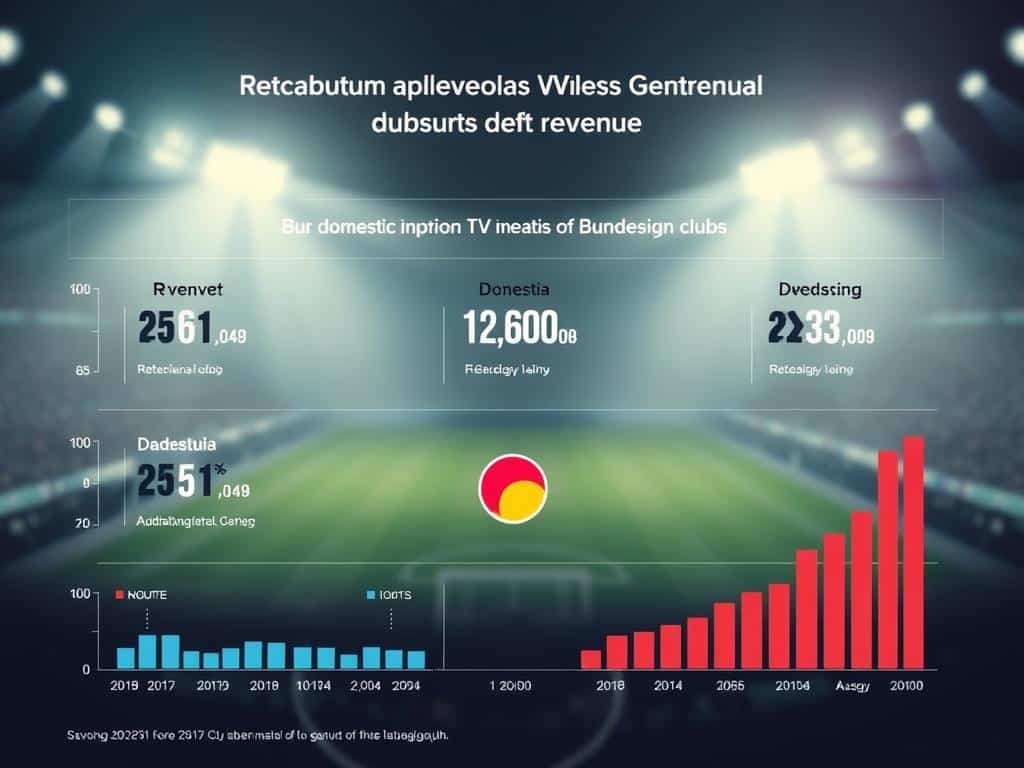

German football just scored big! The Bundesliga locked in a massive €4.5B domestic deal starting in the 2025-26 season. Despite economic hurdles, this marks a 2% increase from the last agreement—proof of the league’s growing appeal.

Fans can expect major changes. Saturday’s Konferenz shifts to DAZN, while Sky takes over Friday nights. If you’re budgeting, Sky costs €25/month, and DAZN runs €29.99. Which pass will you choose?

This deal isn’t just about numbers. It signals a bold future for football broadcasting. Want to see how it stacks up against other leagues? Check out our Premier League deep dive for context.

Bundesliga TV Rights Deals: A €4.5 Billion Boost for German Football

The future of football broadcasting just got brighter! A landmark agreement promises €1.121 billion per season from 2025 to 2029, totaling €4.484 billion over four years. This marks a heartening recovery from the pandemic’s €200M dip, proving the league’s resilience.

Key Financials: €1.1 Billion Per Season

Clubs are the big winners here. The deal ensures steady funding, with media rights revenue split across 36 teams. For context, that’s €31.1M annually per club—enough to scout top talent and upgrade facilities.

Behind the scenes, drama unfolded. DAZN’s €1.6B bid almost collapsed over payment terms but was saved by arbitration. DFL CEOs called it a “win for trust and unity.”

Sky and DAZN Split: New Scheduling Changes

Get ready for a fresh viewing experience. DAZN takes over Saturday’s Konferenz (4-5 simultaneous games), while Sky grabs Friday nights. Here’s the breakdown:

- Sky: Friday matches + Saturday evening slot

- DAZN: Saturday Konferenz + Sunday games

With 612 matches split annually, fans will need both platforms to catch every kick. Time to pick your package!

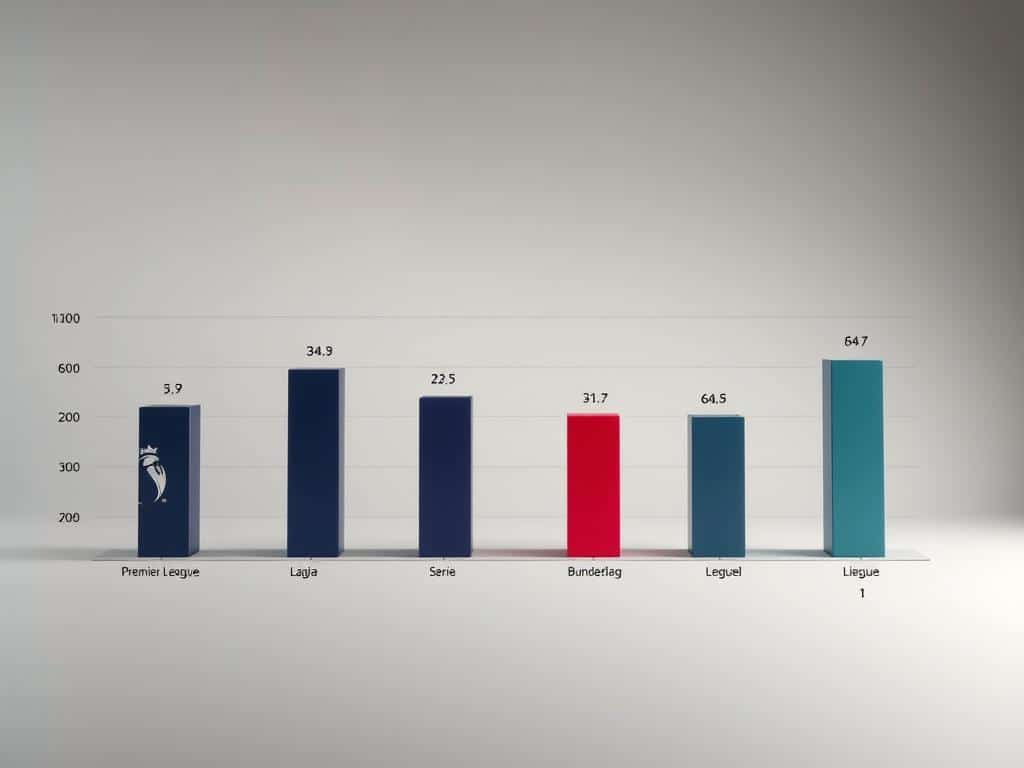

How the Bundesliga Stacks Up Against Europe’s Top Leagues

Europe’s football leagues are in a fierce financial race, and the Bundesliga is gaining ground. While Germany’s top flight trails the Premier League in revenue, its latest agreement proves it’s closing the gap. Let’s break down how it compares to Europe’s elite.

Premier League Dominance vs. Bundesliga’s Growth

The Premier League remains the king of media earnings, pulling in €2.02 billion yearly—nearly double the Bundesliga’s €1.12 billion. But Germany’s model is unique. Its 36 clubs share profits across two tiers, while England splits funds based on appearances and merit.

Bayern Munich’s 11-title streak shows the league’s competitive challenge. Yet, this consistency also fuels global fan interest. The Bundesliga’s next goal? Narrowing the €800M international sales gap with England.

Ligue 1, Serie A, and La Liga: A Revenue Comparison

France’s Ligue 1 (€500M) lags behind, while Italy’s Serie A (€900M) and Spain’s La Liga (€990M) sit closer to the Bundesliga. Germany’s 80:20 revenue split between divisions outshines La Liga’s rigid structure.

DFL chief Hans-Joachim Watzke calls it a “good day for German football.” With smarter distribution and global outreach, the Bundesliga is poised to climb even higher.

Domestic Impact: Why German Clubs Are Celebrating

From historic giants to rising stars, every club benefits from this landmark deal. The €4.5 billion agreement ensures fair payments across all divisions, blending competition with solidarity. Here’s how it transforms german professional football.

Revenue Distribution: Balancing Performance and Popularity

Half the funds are split equally among clubs, while 43% rewards on-field success. The rest fuels youth development (4%) and a 3% “public interest” fund. This lifeline helps legends like Schalke and Hamburg stay competitive despite recent struggles.

Compare this to England’s second tier, where clubs like Wigan faced bankruptcy. Germany’s model ensures stability. Fan favorites thrive, with Schalke’s 8 titles and HSV’s 6 championships honored through strategic support.

- Equal share: €30.5M average per club annually

- Performance bonus: Top teams earn extra for league position

- Youth focus: Funds academies to nurture future stars

Watzke’s Verdict: “A Great Result for German Football”

Borussia Dortmund’s CEO Hans-Joachim Watzke praised the deal’s fairness: “It protects solidarity in a league of 36 clubs.” Even Angela Merkel endorsed it, noting it rewards “sporting performance and growth.”

For fans, this means more thrilling games as clubs invest in talent. The next five years promise a stronger, more exciting german professional football landscape.

The Global Challenge: Expanding Bundesliga’s International Appeal

German football’s global footprint is expanding fast! New broadcasters like Setanta (Baltics) and Tring (Balkans) will air 612 matches yearly, including relegation thrillers. This deal taps into fresh markets, from Lithuania to Russia.

Infront’s Robert Kranz sums it up: “We’re turning fandom into revenue.” Their territory-specific marketing targets Gen Z with Bayern’s Mathys Tel leading Instagram campaigns. Smart moves to increase engagement.

Next stop? The Americas. ESPN+ is key for U.S. growth, while Latin America’s passion for football offers huge potential. With €263M in media rights sales (vs. Premier League’s €1.69B), there’s room to climb.

Which match will you stream first? The international appeal kicks off now!